Solutions

Portfolio Management

Overview

Portfolio management is a set of strategic decisions that guide investors, by selecting the best available financial assets that will provide the expected rate of return for any given degree of risk, as well as mitigate (reduce) risk. The objectives of portfolio management are applicable to all financial portfolios, e.g.: investment safety or minimization of risk,stability of returns,capital growth, liquidity, etc. If taken into account, these objectives result in a proper analytical approach towards portfolio growth. The following steps are applicable:

- Asset allocation / Portfolio structuring;

- Portfolio evaluation;

- Scenarios and stress testing;

- Portfolio optimisation;

- Limit and compliance;

- Performance calculation;

- Basic sensitivities – durations, historical and implied volatilities, etc.;

- Base point value, key rate;

- Hedging by BPV, Beta;

- Scenario projection – portfolio theoretical value development over time.

Scenarios / Stress Testing Module

Provides means to define different strategies for scenario changes in the market environment in order to compose real world scenarios, such as crisis, growth, market shocks, issuer defaults, refinancing costs, etc.

Portfolio Optimisation Module

Performs the optimisation of risk and return, and presents proposals for portfolio restructuring in the presence of different scenarios, user defined restrictions and preferences. For example, investments in EUR > 30% and investments in USD < 40%.

Limit and Compliance Module

Enables the grouping of positions according to different parameters and compares specific aggregates against target limits. This enables continuous tracking of the portfolio’s current state and alerts in case of broken limits. A limit example: all positions in EUR must have a present value that is below 5 Mio. EUR and the three biggest positions in USD should not allocate more than 30% of the total investments in USD.

Performance Calculation Module

Position and portfolio performance is calculated for a specific historical period and includes transactions. The performance is separated into realised, non-realised and FX-effects, which are aggregated along the sub-portfolio hierarchy. In addition, performances can be tracked against multi-level benchmark.

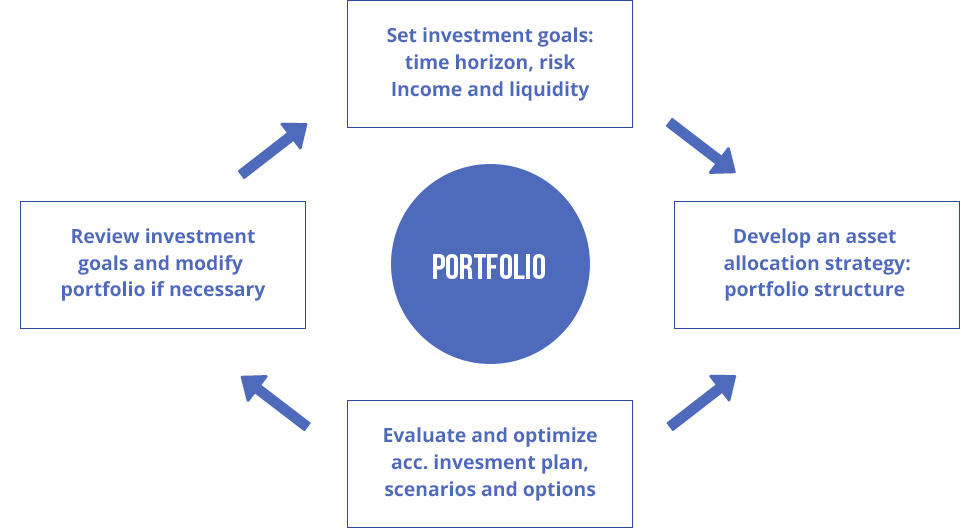

Portfolio management process flow

- Setting of investment objectives: time horizon, risk tolerance, income needs, liquidity requirements.

- Developing an asset allocation strategy. The portfolio is a set of specific types of objects (e.g. positions) that can be defined, using predefined lists, filters or both. Within a portfolio, hierarchical dependencies between sub-portfolios can be defined, using predefined structures, that are based on the portfolio content (e.g. according to currencies in the portfolio). Lists, filters and structures define the portfolio’s asset allocation. Models working with portfolios, lists, filters, and structures require the registration of these objects in a catalogue, according to the object type.

- Evaluating the selected investment schema.

- Reporting locally in different formats, e.g. Excel, Crystal report, OLAP reporting and QlikView.

- Portfolio reviewing process, answering questions on whether the portfolio meets the selected set of objectives or performs consistently with predefined expectations. A portfolio’s investment objectives can be reviewed and modified as needed.

Functionality

Asset Allocation / Portfolio Structuring

- Multi-level portfolio (re)structuring based on calculation results and position properties.

- Allocation of positions, e.g. by currencies and maturity bands.

- Static and dynamic portfolio structuring.

Portfolio Evaluations

- All evaluations are performed according to a selected market scenario.

- Results are aggregated on every level of the portfolio structure.

- Multiple market scenarios are applicable and can be compared at all levels.

Calculated results and figures include:

- Market and theoretical values, Profit / Loss.

- Market and paid prices at the beginning and the end of a historical period.

- Accrued interests at the beginning and the end of a historical period.

- Capital and interest rate payments within a historical period.

- Fees and taxes within a historical period.

- Profit / Loss calculation.

- Benchmark tracking.

The functionality is ensured via the following modules and models:

| № | Module List | Models and Functionality |

|---|---|---|

| 1 |

|

|

| 2 | Report Generation |

|

| 3 | System Features |

|

| 4 | Registering Support |

|

Interfaces and Connectors

The Portfolio Management Module inherits the features of Risk Framework Interfaces and Connectors and Risk Engine Interfaces and Connectors.