Products

Risk Framework Functionality

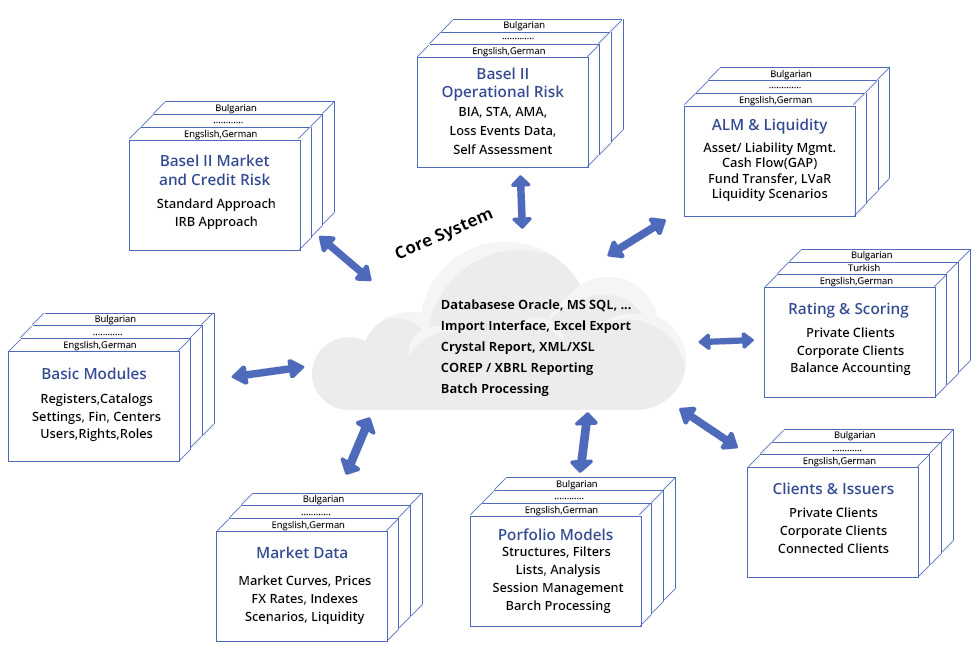

RFW supports - in one or several model sessions - lists of basic objects, such as customers, portfolios, instruments, scenarios, real estate, nomenclatures, settings and market data. Model sessions contain primary information for the definition of the system's functionality and competence. This is ensured in a highly flexible manner by the GUI description, the business logic rules and the database structure. Selected modules, along with their models, create sub-applications in desired areas. For example, models for credit risk, rating, collateral management and COREP-reporting support the Basel III credit risk sub-application. RFW is highly extendable, enabling the adding or extending of models. In this way, it ensures a rapid development and adaptation of user requirements in an unlimited number of application areas and their combinations. RFW accesses data using independent layers to database management systems, connectors and imports / exports, enabling an easy integration into existing systems. For more information on RFW modules and their functionalities see the table below.

| № | Module List | Functionality |

|---|---|---|

| 1 | System Models |

|

| 2 | Administrative Models |

|

| 3 | Portfolio Management |

|

| 4 | Market Data and Scenarios |

|

| 5 | ALM Instruments, ALM Analysis |

|

| 6 | Market Risk Basel III, Internal Models |

|

| 7 | Operational Risk Basel III |

|

| 8 | Credit Risk Basel III, Internal Models |

|

| 9 | Solvency II |

|

| 10 |

|

|

| 11 | Limit and Notification |

|

| 12 | Framework Applications |

|

The usage of models provides the means for an easy and flexible customisation (change) or functionality enhancement of the system by modifying or adding new model scripts. RFW establishes a platform for development of software applications based on a modern paradigm of object-oriented programming, artificial intelligence, neural networks, statistics and simulation.

For more information see A short overview of Risk Framework's functionalities in Bulgarian language